The United Kingdom faces an unprecedented economic challenge as Italy surpasses the UK in GDP per capita for the first time since 2001, whilst the nation grapples with tax rates set to rise to a post-war high and sluggish growth prospects. This convergence of factors creates a perfect storm that threatens to reshape Britain’s economic landscape, with far-reaching implications for small businesses, landlords, and ordinary citizens.

The Numbers Don’t Lie: UK Growth Stutters

Britain’s economic engine has been running on fumes. The UK’s economy grew by just 1.1% in 2024, a marginal improvement from the anaemic 0.4% recorded in 2023. To put this in perspective, GDP per capita has risen by only 0.7% annually from 2007 to 2024, compared to 2.5% during the credit bubble from 1990 to 2007. Even more striking, average wages adjusted for inflation in early 2024 were roughly the same as in 2008 – a lost decade and a half for British workers.

The outlook remains grim. The OECD has lowered its forecasts for UK GDP growth in 2025 from 1.4% to 1.3% and downgraded 2026 forecasts from 1.2% to 1.0%, citing mounting challenges from trade barriers and policy uncertainty.

Italy Overtakes Britain: A Historic Reversal

In a development that would have seemed impossible just a few years ago, Italy has surpassed the United Kingdom in GDP per capita according to World Bank data, marking the first time since 2001. This represents more than just statistical rivalry – it signals a fundamental shift in European economic dynamics.

Several factors have contributed to this reversal. Italy has benefited from substantial EU recovery funds following the pandemic, whilst the UK has struggled with post-Brexit adjustments and policy uncertainty. Additionally, Italy’s GDP recovery has been supported by fiscal measures, though real wages have not yet recovered to pre-pandemic levels, unlike in the UK.

Tax Burden Reaches Post-War Peak

Adding to the UK’s woes is an unprecedented tax burden. The Office for Budget Responsibility forecast in March 2023 that the UK’s tax burden was set to rise to a post-war high. This represents a significant shift from historical norms and places additional pressure on an already struggling economy.

Current tax rates remain substantial, with basic rate taxpayers paying 20%, higher rate taxpayers paying 40%, and additional rate taxpayers facing a 45% rate. These rates, combined with frozen tax thresholds, effectively create stealth tax increases through fiscal drag.

The Immigration Factor: Pressure on Public Services

The UK continues to experience significant immigration pressures, with ongoing challenges from both legal migration and irregular arrivals. Whilst immigration can provide economic benefits through labour supply and tax contributions, the current scale and management of migration flows creates particular pressures on housing, public services, and labour markets in certain sectors.

The fiscal impact of immigration remains complex, with different migrant groups contributing differently to public finances. However, the immediate pressures on housing and public services are tangible, contributing to public frustration and political tensions that further complicate economic policy-making.

Impact on Small Businesses: Squeezed from All Sides

Small businesses – the backbone of the British economy – face a particularly challenging environment:

Rising Costs: High tax rates, including corporation tax increases and national insurance contributions, directly impact profitability. Many small businesses operate on thin margins and cannot easily absorb these additional costs.

Regulatory Burden: Post-Brexit administrative requirements and evolving regulations create additional compliance costs, particularly burdensome for smaller enterprises lacking dedicated administrative resources.

Labour Market Pressures: Skills shortages in certain sectors, combined with immigration policy changes, have created recruitment challenges. Simultaneously, wage pressures from inflation and labour market tightness squeeze margins further.

Reduced Consumer Spending: With household incomes stagnating and living costs rising, consumer demand remains subdued, directly impacting retail and service businesses.

Access to Finance: Economic uncertainty and banking sector caution make it increasingly difficult for small businesses to secure growth capital, limiting expansion opportunities.

Landlords Face a Perfect Storm

The buy-to-let sector faces unprecedented challenges that threaten its viability:

Tax Changes: The removal of mortgage interest tax relief, higher stamp duty rates, and capital gains tax increases have fundamentally altered the economics of property investment.

Regulatory Pressure: Increasingly stringent regulations on energy efficiency, safety standards, and tenant rights create ongoing compliance costs and potential legal risks.

Market Conditions: Rising mortgage rates, combined with rent controls and eviction restrictions, squeeze rental yields whilst increasing operational risks.

Capital Requirements: New regulations requiring substantial property improvements for energy efficiency force landlords to invest significant capital with uncertain returns.

Exit Barriers: High capital gains tax rates make it expensive to exit the market, trapping many landlords in increasingly uneconomical investments.

The Human Cost: What This Means for Ordinary People

The economic stagnation and policy challenges translate into real hardship for British families:

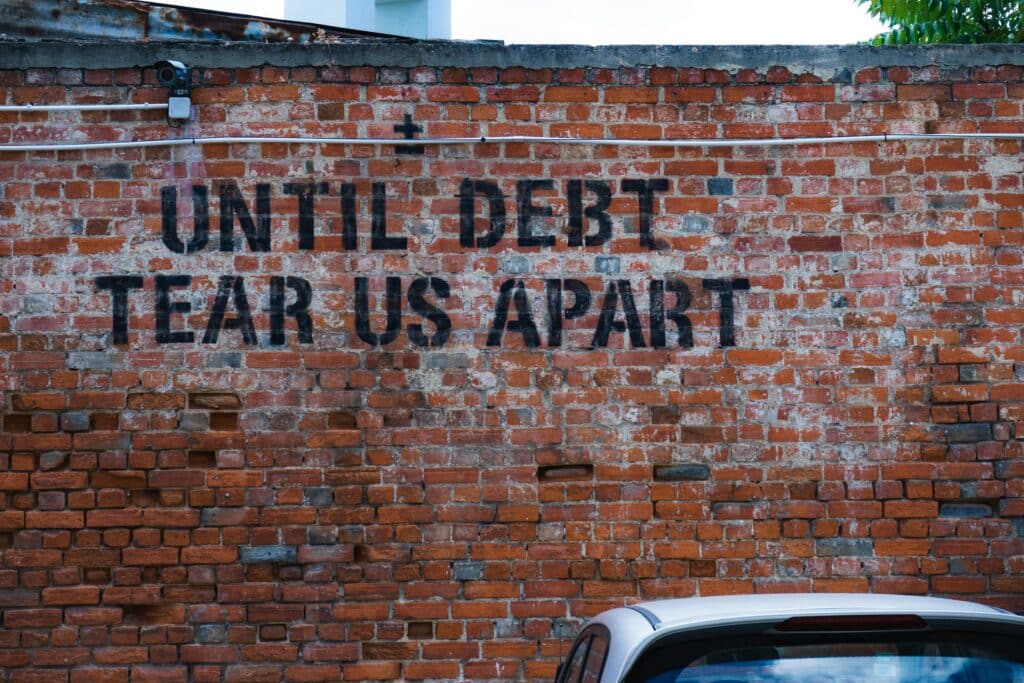

Living Standards: With wages stagnating in real terms since 2008, many households find themselves worse off than their parents’ generation, breaking a centuries-old pattern of intergenerational progress.

Housing Affordability: The combination of high property prices, reduced rental supply, and mortgage affordability constraints makes decent housing increasingly unattainable for young people and families.

Public Services: Strained public finances and growing demand pressure public services, leading to longer waiting lists, reduced service quality, and increased reliance on private alternatives.

Career Prospects: Limited business investment and economic growth constrain job creation and career progression opportunities, particularly in higher-skilled, higher-paid roles.

Retirement Security: Low growth and market volatility threaten pension adequacy, whilst higher taxes reduce the ability to save for retirement.

Looking Ahead: Policy Implications

The convergence of these challenges requires a fundamental reassessment of Britain’s economic strategy. Several key areas demand attention:

Tax Reform: The current tax burden may be counterproductive, discouraging investment and entrepreneurship. A comprehensive review of the tax system could identify opportunities to boost growth whilst maintaining revenue.

Regulatory Reform: Reducing regulatory burdens, particularly on small businesses, could unleash entrepreneurial energy and improve competitiveness.

Infrastructure Investment: Strategic infrastructure investment could boost productivity and create the foundation for sustained growth.

Immigration Policy: A more strategic approach to immigration that balances economic benefits with public service capacity could reduce tensions whilst supporting growth sectors.

Housing Supply: Addressing the housing crisis requires both planning reform and policies that encourage rather than discourage rental supply.

Conclusion: Britain at a Crossroads

The UK stands at a critical juncture. The combination of stagnant growth, high taxes, and mounting policy challenges threatens to entrench economic underperformance for years to come. The symbolic overtaking by Italy in GDP per capita should serve as a wake-up call – Britain’s economic model requires urgent reform.

Success will require difficult choices and political courage. The alternative – continued stagnation, declining living standards, and reduced international competitiveness – represents a future no British politician should accept. The time for half-measures has passed; Britain needs a comprehensive economic strategy that prioritises growth, competitiveness, and opportunity.

The stakes could not be higher. Without decisive action, the UK risks becoming a European laggard, watching as other nations surge ahead whilst British families face a future less prosperous than the past. The economic data tells a clear story – the question now is whether Britain’s leaders will listen and act accordingly.

Navigate These Challenges with Expert Support

In these uncertain economic times, having the right financial guidance isn’t just helpful—it’s essential for survival and growth. Whether you’re a small business owner struggling with rising tax burdens, a landlord navigating complex regulatory changes, or an individual seeking to protect your financial future, professional accounting support can make the difference between thriving and merely surviving.

Ready to take control of your financial future? Book a free consultation to discuss how we can help you navigate these challenging economic times.

Follow us on Facebook, Instagram and LinkedIn for more updates.