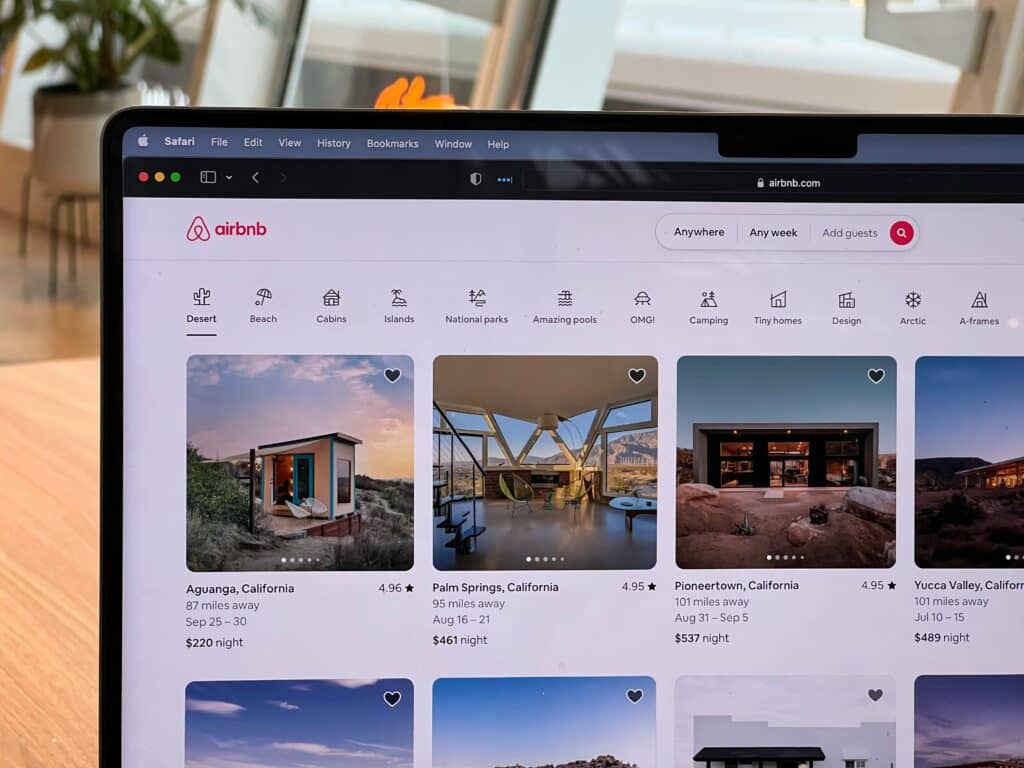

Accounting Services for Airbnb Businesses

Running an Airbnb or short-term rental property can be a profitable venture, but it also comes with financial complexities, including tax compliance, expense management, and navigating ever-changing regulations. At Jermyn & Co, we provide specialised accounting services tailored for Airbnb hosts and short-term rental property owners, helping you streamline your finances, reduce tax liabilities, and maximise your earnings.

Whether you own a single property or manage a portfolio, our expert team ensures your business is compliant, efficient, and profitable.

Why Jermyn & Co?

Why Choose Jermyn & Co for Airbnb Accounting?

Airbnb hosts face unique financial challenges, from tracking variable income to managing property expenses and meeting tax obligations. At Jermyn & Co, we help you:

- Stay Compliant – Navigate HMRC rules for rental income, VAT, and reporting requirements.

- Maximise Tax Efficiency – Claim allowable expenses and reliefs to reduce liabilities.

- Simplify Finances – Streamline bookkeeping and income tracking for multiple properties.

- Plan for Growth – Develop strategies to expand your rental portfolio or enhance profitability.

With our tailored approach, you can focus on providing excellent guest experiences while we manage the financial details.

Accurate Records

Tax Savings

Time Savings

Scalability

Jermyn & Co

Core Accounting Services for Airbnb Hosts

We provide a comprehensive range of accounting services designed for short-term rental owners, including:

1. Bookkeeping and Expense Management

Keeping accurate financial records is essential for Airbnb hosts. We assist with:

- Tracking income from bookings, cleaning fees, and additional services.

- Managing property expenses such as maintenance, utilities, and furnishings.

- Organising receipts and invoices for tax reporting and financial planning.

2. Tax Planning and Compliance

Short-term rental income is subject to specific tax rules. Our tax services include:

- Preparing and filing self-assessment tax returns to report rental income.

- Advising on tax reliefs, such as Furnished Holiday Lettings (FHL) Relief.

- Ensuring compliance with VAT thresholds and regulations if applicable.

3. Furnished Holiday Letting (FHL) Qualification

If your Airbnb qualifies as a furnished holiday let, you may benefit from significant tax advantages. We help you:

- Determine if your property meets FHL criteria, including occupancy thresholds.

- Claim FHL-specific reliefs, such as capital allowances and entrepreneur’s relief.

- Optimise your tax position to maximise savings.

4. VAT and Digital Platforms Compliance

For high-earning hosts or those managing multiple properties, VAT compliance can be complex. We assist with:

- VAT registration and guidance on applicable schemes.

- Navigating VAT rules for platforms like Airbnb and other digital marketplaces.

- Preparing and filing VAT returns in line with Making Tax Digital (MTD).

5. Cash Flow Management and Profitability Analysis

Short-term rentals often experience seasonal income fluctuations. We provide:

- Cash flow forecasting to manage expenses during quieter periods.

- Profitability analysis to identify your most lucrative properties or services.

- Budgeting tools to plan for property upgrades or additional investments.

6. Strategic Planning for Portfolio Growth

Looking to expand your Airbnb business or diversify your properties? We offer:

- Long-term planning to build a profitable and sustainable portfolio.

- Financial modelling to assess the viability of new investments.

- Guidance on financing options for purchasing or upgrading properties.

Jermyn & Co

What our clients say about their experience with us

Jermyn & Co

Frequently Asked Questions about Airbnb & Short Term Rental Accounts

You can claim expenses such as property maintenance, utilities, cleaning, furnishings, advertising, and platform fees. We ensure all allowable deductions are included in your tax filings.

FHL Relief provides tax benefits for properties that meet specific criteria, including minimum occupancy requirements. We’ll assess your property and help you claim this valuable relief if applicable.

If your rental income exceeds £85,000, VAT registration is mandatory. We’ll guide you through compliance with VAT rules specific to short-term rentals.

Yes, we provide tailored bookkeeping and financial reporting solutions to help you track income, expenses, and profitability across your portfolio.

Our Accountancy Services

We offer a range of services to help you manage your finances and grow your business.

Why Jermyn & Co?

Why Choose Jermyn & Co for Your Accounts?

At Jermyn & Co, we’re more than just accountants – we’re your partners in success. Our accountancy services are designed to help you:

- Stay Compliant – Ensure your financial records meet HMRC and Companies House requirements.

- Save Time – Let us handle the numbers while you focus on growing your business.

- Improve Efficiency – Streamline processes and reduce errors with expert support.

- Plan for Growth – Use actionable insights to guide your financial decisions and achieve your goals.

With our proactive approach, you’ll gain the confidence and clarity you need to succeed.

Why Jermyn & Co?

Why Choose Jermyn & Co for Business Tax?

Tax legislation in the UK can be complex and ever-changing, but with Jermyn & Co by your side, you’ll have access to expert advice and practical solutions.

Our services include:

- Strategic Tax Planning – Helping your business plan effectively to reduce your overall tax liabilities.

- Corporation Tax Filing – Ensuring accurate and timely submissions to HMRC.

- VAT Compliance – Assisting with VAT registrations, returns, and managing thresholds.

- R&D Tax Credits – Maximising available credits for your innovation and development projects.

- Self-Assessment Support – Tailored assistance for self-employed individuals or partnerships.

With our expertise, you can focus on running your business while we handle the numbers. We’re committed to helping you stay ahead of deadlines and legislation changes.

Corporation Tax Compliance

VAT Services

R&D Tax Credits

Tax Planning and Advisory

Why Jermyn & Co?

Why Choose Jermyn & Co for Personal Tax?

At Jermyn & Co, we understand that everyone’s financial situation is unique. Our personal tax services are designed to help you:

- Optimise Tax Efficiency – Leverage allowances, reliefs, and deductions to minimise your tax liability.

- Ensure Compliance – Stay on top of filing deadlines and HMRC requirements to avoid penalties.

- Plan for the Future – Align your tax strategy with your long-term financial goals.

- Simplify Tax Complexity – Let us handle the details so you can focus on what matters most.

From simple tax returns to complex financial arrangements, we provide expert advice and support tailored to your needs.

Proactive Tax Planning

Expert Guidance

Tailored Solutions

Stress-Free Compliance

Why Jermyn & Co?

Why Choose Jermyn & Co for Corporate Finance?

At Jermyn & Co, we understand that every business is unique. Our experienced team offers a personalised approach to corporate finance, helping you:

- Secure Financing – Access the funding you need for expansion, acquisitions, or working capital.

- Plan for Growth – Develop tailored financial strategies to achieve your business objectives.

- Manage Mergers & Acquisitions – Navigate complex transactions with confidence, from valuations to negotiations.

- Optimise Financial Performance – Streamline processes, reduce costs, and maximise profitability.

Whether you’re a start-up seeking investment or an established business exploring new opportunities, we’ll provide the expert guidance you need to succeed.

Business Valuations

Mergers & Acquisitions (M&A)

Fundraising & Investment

Financial Modelling

& Forecasting

Why Jermyn & Co?

Why Choose Jermyn & Co for HR Services?

At Jermyn & Co, we understand that every business is unique, and so are its HR needs. Our tailored HR services help you:

- Stay Compliant – Meet the latest UK employment laws and regulations with ease.

- Save Time and Resources – Let us handle the admin while you focus on growing your business.

- Engage Your Team – Build a positive, productive workplace with our employee engagement solutions.

- Grow with Confidence – Ensure your HR strategy aligns with your long-term business objectives.

Whether you need ongoing HR support or help with a specific issue, our experienced team is here to assist.

Payroll Management

HR Compliance

Employee Engagement & Retention

Training & Development

Why Jermyn & Co?

We offer tailored accounting services to various sectors through Norfolk & Suffolk.

Jermyn & Co

How We Help Airbnb Hosts Succeed

At Jermyn & Co, we provide more than just accounting services – we deliver strategic support to help Airbnb hosts and short-term rental owners thrive. From managing day-to-day financial operations to planning for long-term growth, our proactive approach ensures your business is financially sound and future-ready.

Ready to Maximise Your Rental Income?

Talk To Us

Schedule a consultation to discuss your accounting needs.

Plan and Implement

We’ll create a customised financial strategy for your rental business.

Achieve Results

Streamline your finances, stay compliant, and grow your business with expert support.